Reasons You Need a Trust

Reasons You Need a Trust

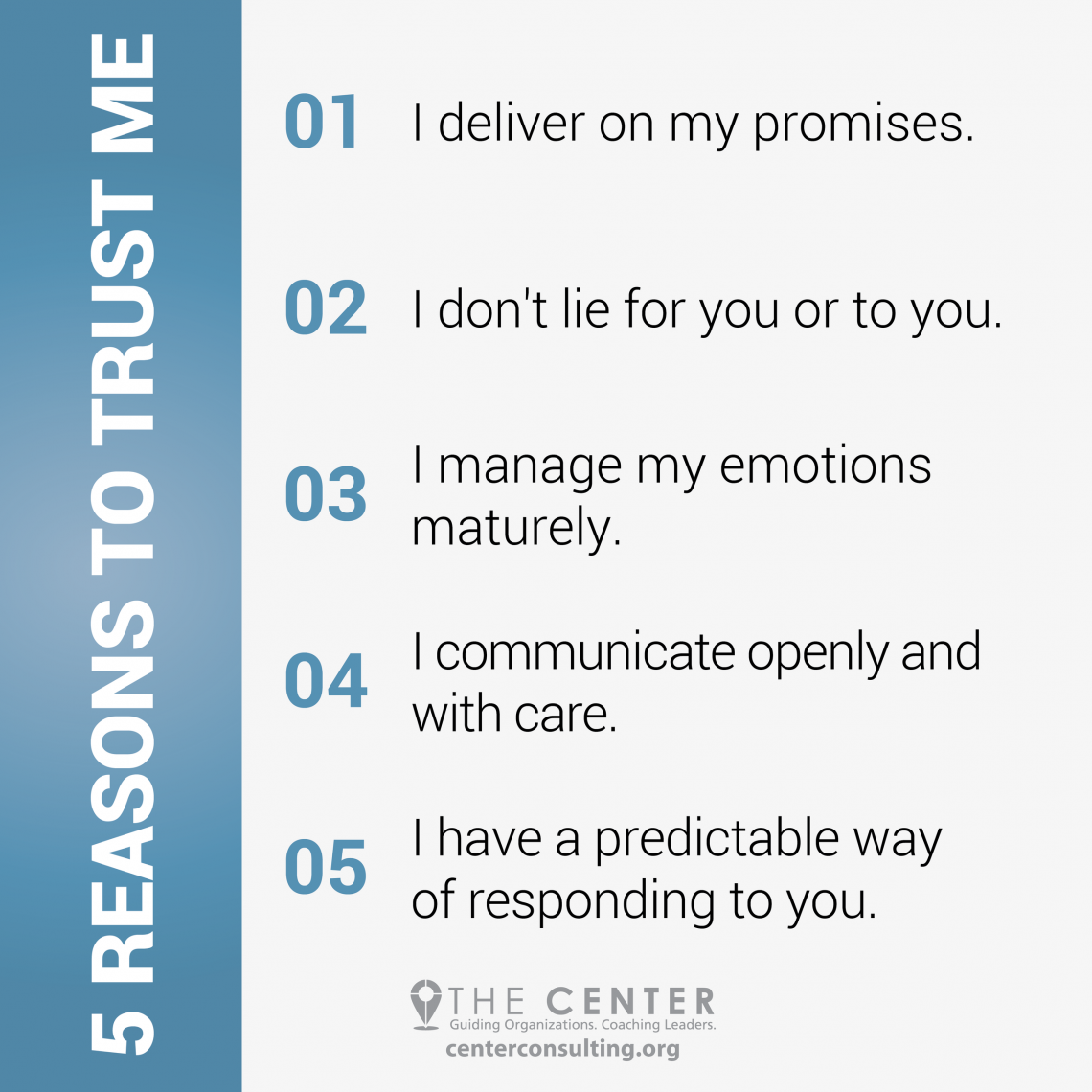

There are many reasons to establish a trust. These include avoiding provincial surtaxes and protecting assets from potential conflicts of interest. This article will discuss some of the other reasons to create a trust. The benefits of establishing a trust can’t be emphasized enough. However, before you start planning for the future, you should consider a few of the most common reasons people create a trust. These are: (1) Protecting your family from potential creditors; (2) Avoiding estate taxes; and (3) Controlling the distribution of assets to your beneficiaries.

Avoiding provincial surtaxes with a trust

There are many ways to avoid provincial surtaxes when creating a trust. One option is to create an Alberta-resident trust, which will allow income to be taxed at Alberta rates. A trust can be created by transferring assets to it or emigrating an existing trust to Alberta. By establishing an Alberta-resident trust, income from the trust can be taxed at Alberta rates, and then distributed to beneficiaries outside of the province.

The third option is to keep the $3 million in a trust and reinvested, with the income taxed at Alberta rates. This option is not permitted to be returned to the shareholder; otherwise, subsection 75(2) applies. Estate Planning Lawyer It is important to understand how these changes affect a trust’s ability to distribute income. In the first scenario, the trust would have been forced to distribute income to its unitholders.

Controlling asset distributions

One of the most important components of estate planning is controlling asset distributions. You can choose a type of trust to control how your assets will be divided after you die. Some trusts are more appropriate for larger estates than others, and you can decide if you would like to make distributions based on certain events. The following scenarios are examples of the advantages and disadvantages of each type of trust. For more information, contact an estate planning attorney.

There are tax benefits to leaving assets in a trust. The assets will be taxed differently than they would have been had you distributed them outright to your beneficiaries. Moreover, your beneficiaries are not responsible for the debts of the trust. Instead, your beneficiaries will only have to pay taxes on income retained by the trust, and that may not be the case with all estates. You can also use a trust to purchase a house for your beneficiary.

Protecting assets from a potential conflict of interest

A significant source of Contingent Liabilities is self-dealing, which may be considered a conflict of interest by some. In the case of a bank insider, the potential for self-dealing is not less severe. However, if the insider is in a position of influence over the bank’s financial affairs, protecting assets from a potential conflict of interest may be essential to avoiding a conflict of interest.

Avoiding estate taxes with a trust

The current legislation on the federal estate tax and other tax issues is threatening to eliminate some of the benefits of a trust by repealing the GRAT and other estate-tax-avoidance techniques. Unlike the GRAT, which will continue to be legal under current law, however, other forms of trust will no longer be effective in avoiding the tax. Listed below are a few of those benefits. A properly drafted trust instrument can help reduce the estate tax burden.

The IRS defines estate tax as the tax owed on net assets at the time of a person’s death. A trust can be created to avoid the estate tax by transferring assets from one spouse to another. This tax is paid when the trust’s assets are transferred or sold. If a trust is established for a child or a spouse, a child may be named as the ultimate beneficiary. A trust can remove as much as $520,000 from a person’s estate.